Vneuron Compliance Solutions

The complete package for Anti-Money Laundering (AML) and combatting Terrorist Financing (TF)

Vneuron Compliance

Solutions stats

Meet the platform.

Monitored and screened assets

End-Customers

Daily users

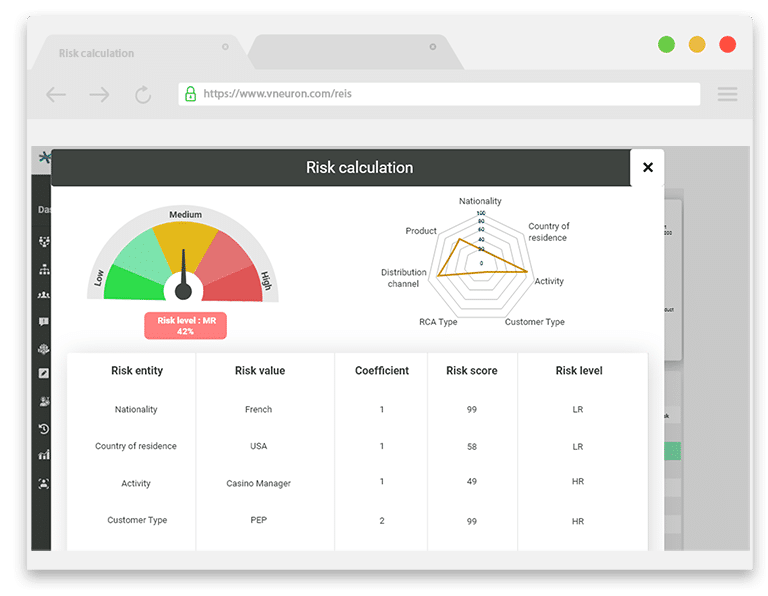

Customer due diligence

Fulfill international risk-based customer due diligence standards.

- Collate all customer information in one place.

- Check customer names through connections to global data providers.

- Merge with existing KYC (Know Your Customer) processes using flexible forms and workflows.

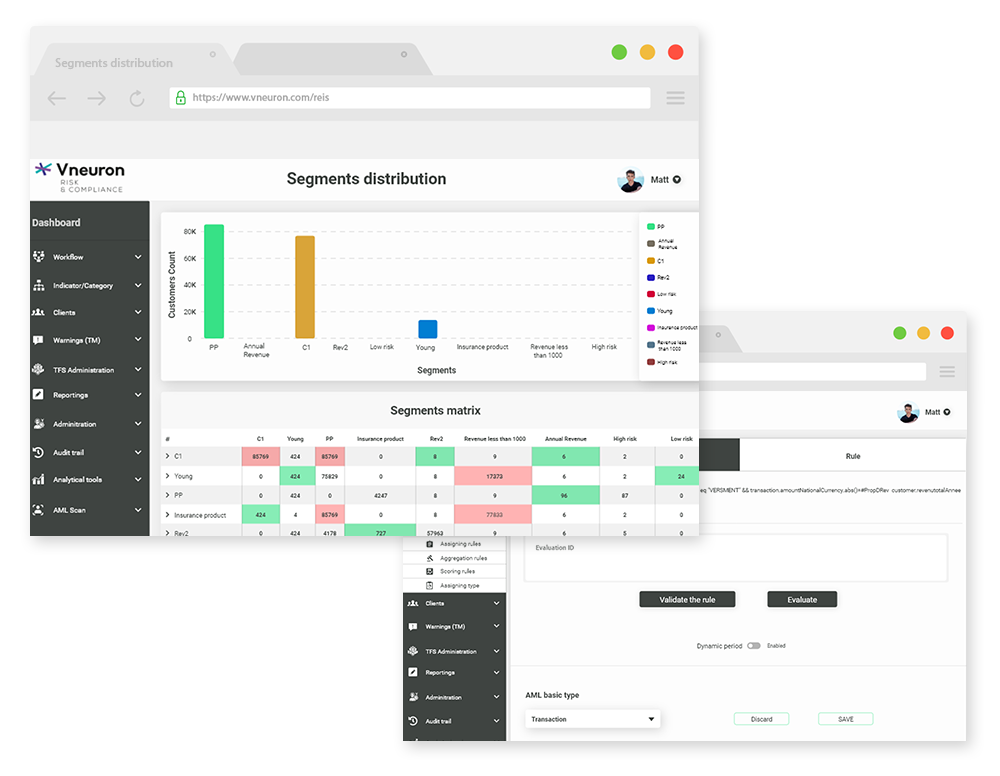

Transaction monitoring

Upgrade to strong sanctions compliance and reduce the risk of money laundering.

- Identify suspicious transactions with real-time, AI-supported, transaction monitoring

- Check transactions against international sanction and watch lists

- Facilitate AML investigations of suspicious activity

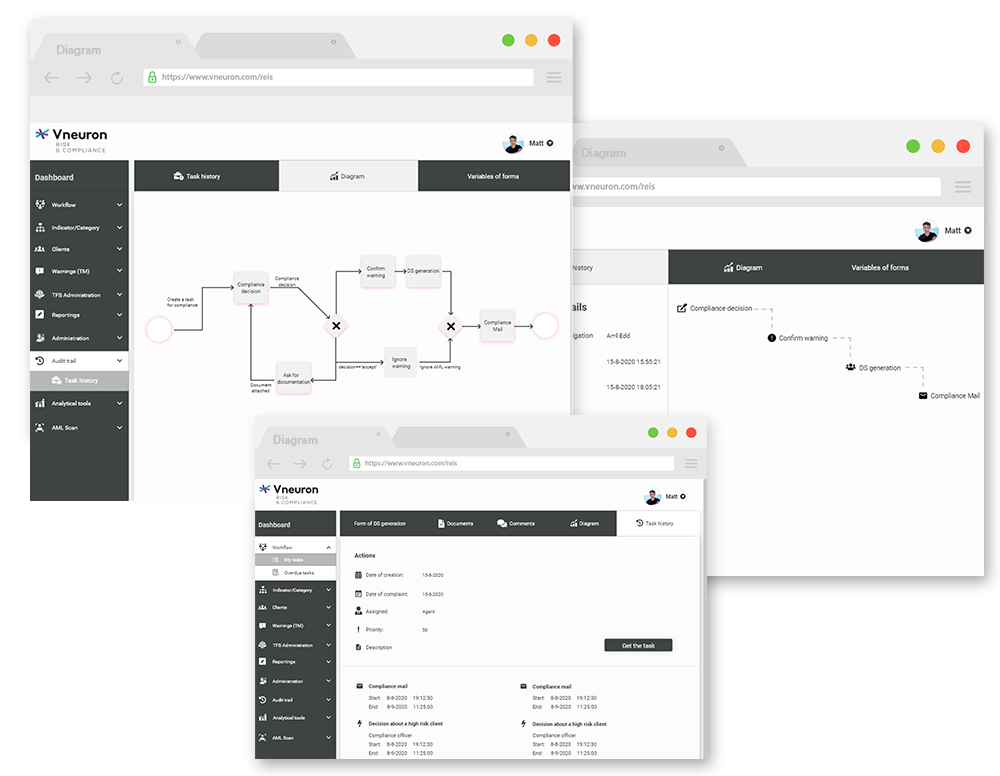

Case management

Help analysts to communicate and speed up case completion.

- Aggregate all the data needed to review suspicious activity

- Collaborate with other team members and stakeholders

- Maximise analyst productivity with flexible workflows

- Automate regulatory SAR (Suspicious Activity Report) filings

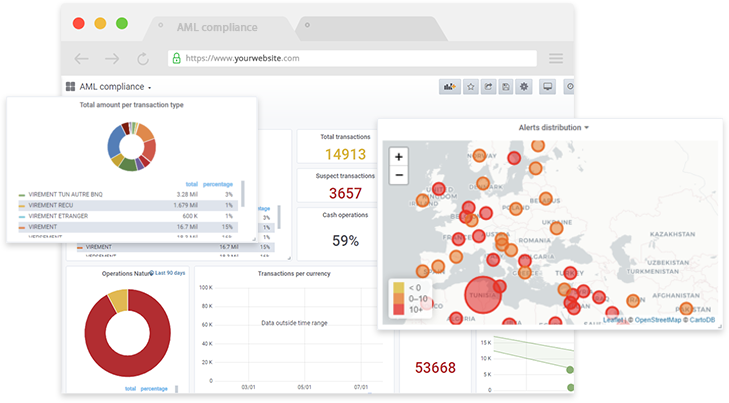

Dashboards, reporting and logging

Improve operational efficiency through the effective presentation of compliance data.

- Align to existing business processes with extensively customisable dashboards.

- Gain meaningful insights into compliance through informative reporting.

- Simplify future audits by the automatic logging of user activity.

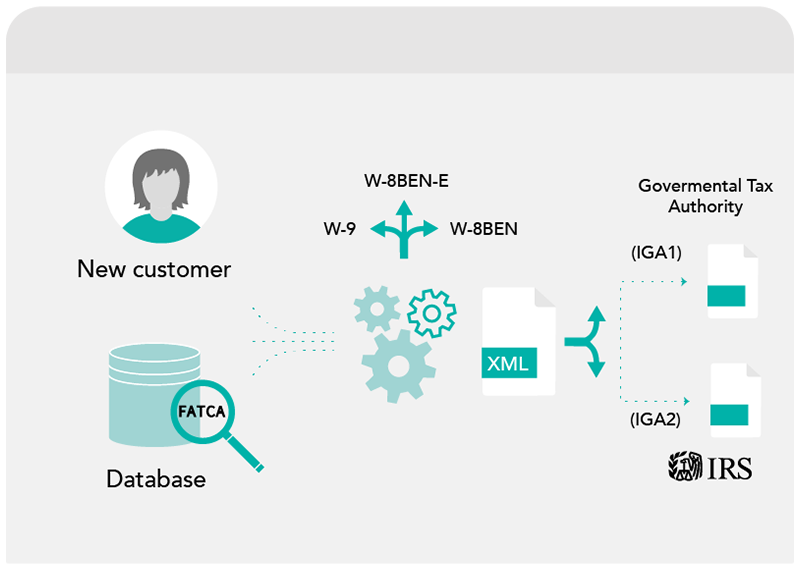

FATCA

Automate FATCA (Foreign Account Tax Compliance Act) reporting and filing.

- End-to-end compliance with the USA IRS (Internal Revenue Service) regulation

- Capture, collate, and validate customer data all in one tool

- Automatically file reports with the IRS

Why to choose Vneuron Compliance Solutions?

Modern software architecture

- Automate compliance processes

- Monitor transactions with machine learning algorithms

- Create bespoke solutions using the compliance suite’s flexible, modular architecture

Simple to deploy

- Fast set-up and fast results

- Quickly meet customer due diligence requirements and anti-money laundering regulations.

- No software to maintain and no infrastructure changes required.

Strong user base

- More than 180 clients have chosen compliance software from Vneuron.

- Including banks, insurance, leasing, stock market intermediaries, investment funds, and micro-finance companies.

Perfect fit for fintech

Enables compliance with PSD2 (Revised Payment Services Directive) for third party payment service and data providers

Built on a cloud microservices architecture with exposed APIs for easy integration

Perfect fit for banks

Perform risk-based due diligence on retail, business, corporate and investment customers

Achieve full regulatory compliance

Lower the cost of compliance with a modern solution incorporating automation and machine learning

Perfect fit for insurers

Designed to operate with the complexity and capacity requirements of large insurers

Suitable for life, capitalization and non-life insurance businesses

Integrate with modern and legacy insurance information and ERP (Enterprise Resource Planning) systems