Vneuron Risk And Compliance Is Participating In The 6th Mena Regtech Series

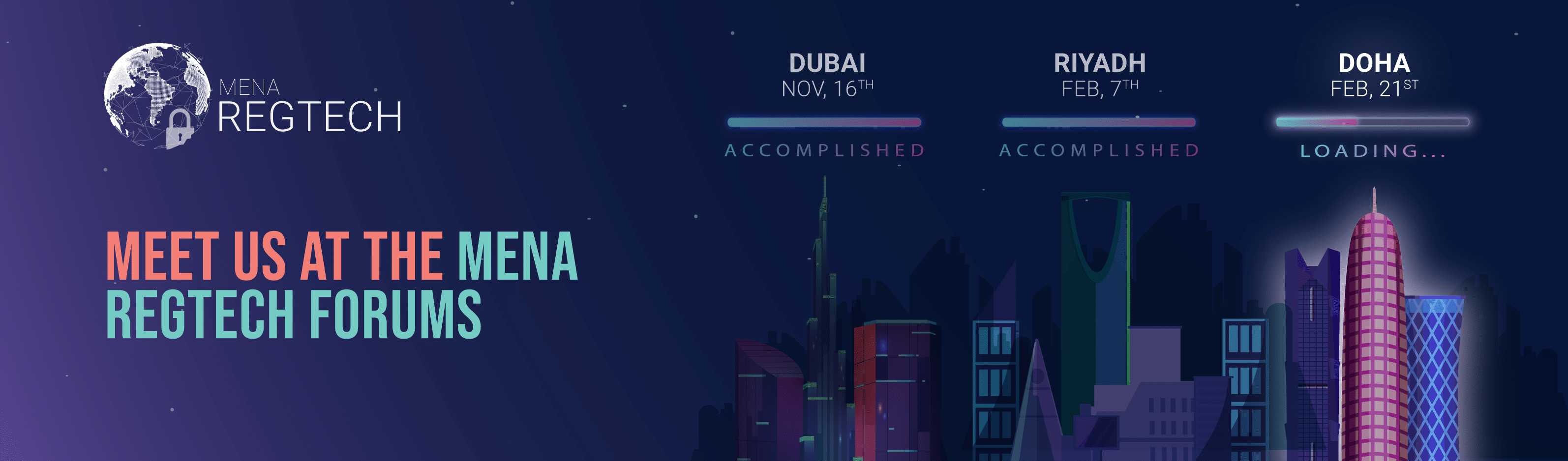

This year’s event comes as a series of the 3 editions happening in Dubai, Riyadh, and Doha gathering top-notch AML compliance experts in one place in the presence of major financial institutions and regulators in the region.

The world of business is constantly evolving, and that means that the strategies used to combat money laundering have to evolve as well.

The global pandemic has affected every economy by disrupting common standards of doing business: digitalization is now the new normal.

Critical sectors such as healthcare, finance, telecommunications, retail, and government are now dealing with new cybercriminals and fraudsters, which led the regulators to adapt and change the AML and CFT laws.

The use of Information Technology to enhance their Regulatory Processes is this year’s topic for the Mena Regtech forum.

Vneuron Risk and compliance is proud to announce its participation as an exhibitor at this year’s series of 3 events.

Participation in this important event is a great opportunity for Vneuron to share its innovative AML compliance solution including KYC, Transaction screening and Monitoring against unusual behavior, and reporting with industry leaders in AML compliance.

The Mena Regtech Event Overview

Vneuron Risk and Compliance is excited to announce its participation in the 6th MENA Regtech series. Having successfully exhibited at the Dubai and Riyadh, we are now heading to the upcoming event in Doha, Qatar on February 21st, 2023.

This event is a great opportunity for us to connect with industry leaders and share our expertise in the field of regulatory technology.

In addition to exhibiting at the event, we are proud to announce that Mr. Mahmoud Mhiri, the CEO and compliance technology expert of Vneuron, will be moderating the session on the topic of “Regulatory Technology reshaping the future of Financial Services” from 14:45 to 15:25.

The panel discussion will feature distinguished speakers, including Mr. Talal Shoukat, Head of Compliance & MLRO at Gulf Exchange, Mr. Muhammad Shahid Farid, Head of AML/CFT and Sanctions at The Commercial Bank, Mr. Benjamin Anafi, Head of Governance Risk and Compliance at Ali Bin Ali, and Mr. Saiful Islam Vaidhyakkaran, Head of Compliance and MLRO at Al Zaman Exchange WLL.

The combination of their extensive knowledge and experience in different aspects of financial compliance and regulatory technologies is sure to provide a comprehensive and thought-provoking discussion on the topic. Mahmoud’s moderation of the session will help ensure that the discussion is engaging, productive, and offers meaningful takeaways for the audience.

During those this edition, the keynote speakers will be also discussing the following topics :

● How to rethink existing approaches?

● Where do industry leaders identify the potential for innovation?

● How to evaluate new technologies?

● How to fit new models of cooperation?

Vneuron Risk and Compliance will be exhibiting at the conference in AL MAS ballroom, booth N°5, in City Centre Rotana hotel, Doha Qatar, to showcase its portfolio of compliance technology solutions.

Vneuron offers a variety of solutions that can be adjusted to your needs to help protect your business against cybercriminals and fraudsters.

You can learn more by booking a live demonstration or visiting www.vneuron.com.