Ultimate Beneficial Ownership Screening: Regulations, Challenges, and Best Practices

In today’s interconnected global economy, the need for transparency and accountability in financial transactions is paramount. Ultimate Beneficial Ownership (UBO) screening has emerged as a necessary requirement in the fight against illicit activities, such as money laundering, corruption, and terrorist financing. Below, we will explore the concept of UBO, delve into recent updates, discuss the challenges associated with UBO screening, examine the role of technology in UBO screening, and provide best practices for effective implementation.

What is ultimate beneficial ownership?

The term “Ultimate Beneficial Owner” (UBO) refers to the individual or individuals who ultimately own or control a legal entity, such as a company or organization, and benefit from its operations and assets.

The UBO is distinct from the legal or registered owner and is often the person or entity with significant influence or economic interest in the entity, regardless of whether they are officially listed as shareholders or directors.

Identifying and understanding the UBO relationship helps authorities and financial institutions assess the potential risks associated with a particular entity, ensuring compliance with legal and regulatory requirements.

By disclosing and maintaining accurate UBO information, countries aim to enhance transparency, integrity, and accountability in corporate structures, bolstering the global fight against illicit activities and promoting a more secure and trustworthy business environment.

Ultimate beneficial ownership (UBO) updates :

UBO global updates :

On March 2022, the FATF strengthened global beneficial ownership standards by requiring countries to provide accurate and updated information on true company owners. Now, the FATF has released updated practical guidance on March 2023 to help countries enforce these standards effectively.

The revised standards aim to prevent criminal organizations, corrupt individuals, and sanctions evaders from using anonymous shell companies to hide illicit activities and dirty money. The guidance assists countries in implementing Recommendation 24 by ensuring that beneficial ownership information is held in a public registry or an alternative mechanism that allows efficient access to the data.

Additionally, the guidance helps countries evaluate and mitigate money laundering and terrorist financing risks associated with foreign companies.

It provides information on relevant sources and types of data, as well as mechanisms to obtain such information. A multi-pronged approach is recommended, combining information from companies, public registries, or alternative mechanisms for swift access to beneficial ownership information.

The guidance is the outcome of extensive consultations with external stakeholders and the private sector. Its goal is to support policymakers, national authorities, and private sector stakeholders in implementing measures that eliminate shell companies as safe havens for illicit proceeds connected to crime and terrorism.

UBO updates in Europe :

According to a press release shared by the European Parliament in March 2023, the Members of the European Parliament have approved stricter rules to combat money laundering, terrorist financing, and sanctions evasion in the EU. They adopted their position on three draft legislations: the EU “single rulebook” regulation, the 6th Anti-Money Laundering directive, and the regulation establishing the European Anti-Money Laundering Authority (AMLA).

The new rules require entities like banks, crypto asset managers, and real estate agents to verify customer identities, assess money laundering risks, and report information to a central register. MEPs also want to limit cash and crypto asset transactions and ban “golden passports” while imposing stronger AML controls on “golden visas.”

Each member state must establish a financial intelligence unit (FIU) to combat money laundering and share information with AMLA, Europol, Eurojust, and the European Public Prosecutor’s Office. Access to information on beneficial ownership, bank accounts, and valuable goods should be provided to FIUs and competent authorities.

Also, the beneficial ownership information should be available digitally in EU languages, and entities in charge of central registers will verify data accuracy. Persons with legitimate interests, including journalists and civil society organizations, should have access to the register.

UBO updates in the Middle East :

Recently, the United Arab Emirates (UAE) introduced a significant legal development regarding beneficial ownership (BO) information. A new law has been enacted, which mandates that all companies registered in the UAE must establish and maintain a register specifically dedicated to recording and documenting their beneficial ownership details. Furthermore, this register must be readily accessible to the UAE authorities whenever they request such information.

Under this law, companies operating within the UAE are now legally obligated to disclose and provide accurate information regarding the individuals or entities that possess the ultimate control or ownership over their operations.

UBO updates in the USA :

The United States of America (USA) is taking proactive steps to enhance its Ultimate Beneficial Owner (UBO) laws, fostering greater transparency and combating money laundering effectively. Recent updates in this regard have highlighted significant regulatory developments by prominent entities such as the Financial Crimes Enforcement Network (FinCEN) and the Office of Foreign Assets Control (OFAC) :

The FinCEN update :

The United States of America (USA) implemented the Corporate Transparency Act (CTA) on January 1, 2021. However, certain aspects of the initial Ultimate Beneficial Owner (UBO) provisions raised questions, prompting the Financial Crimes Enforcement Network (FinCEN) to release final regulations that provide clarification and guidance.

On September 29, 2022, FinCEN announced the final regulations regarding UBO reporting requirements. These regulations will come into effect on January 1, 2024. Until that date, no Beneficial Ownership Information (BOI) will be accepted.

The reporting requirements apply to both domestic reporting companies, which are entities formed by filing paperwork with a US state (such as corporations and LLCs), and foreign reporting companies, which are created under the laws of a different country but registered to conduct business in the US.

Certain entities are exempt from the UBO requirements, including large operating companies, businesses in highly regulated sectors such as banks and insurance providers, subsidiary companies wholly owned by exempt organizations, and entities that have not engaged in active business or held significant assets before January 1, 2020.

Importantly, the UBO information will not be publicly accessible. Failure to comply with UBO reporting requirements can lead to civil or criminal sanctions, including civil fines of up to $500 per day of violation and criminal fines of up to $10,000 and/or imprisonment for up to two years, or both.

The OFAC update :

The Office of Foreign Assets Control (OFAC) is a U.S. government agency that is responsible for enforcing economic and trade sanctions against foreign countries and individuals. OFAC has several regulations that require companies to disclose information about their beneficial owners.

One of these regulations is the 50% Rule, which requires companies to disclose the names of any beneficial owners who own or control at least 50% of the company. The 50% Rule applies to all companies that are subject to OFAC sanctions, regardless of where they are incorporated or where they operate.

The 50% Rule was first introduced in 2016, and it was updated in 2023 to include some new requirements. The updated rule requires companies to disclose the following information about their beneficial owners:

- Name

- Date of birth

- Nationality

- Address

- Occupation

- Source of wealth

The 50% Rule is a significant compliance burden for companies that are subject to OFAC sanctions. However, it is an important tool for OFAC to track down and prosecute individuals and entities that are involved in sanctions evasion.

While there have been notable updates to UBO laws in 2023, reflecting the ongoing efforts to combat money laundering and terrorist financing, financial institutions encounter various challenges in ensuring effective UBO screening and compliance.

UBO screening challenges

Implementing UBO screening is a critical compliance requirement for financial institutions, serving as a vital defense against money laundering and other financial crimes. However, several challenges arise in conducting effective UBO screening, requiring proactive measures and innovative approaches :

- Data quality and availability: Poor data quality hampers the accurate identification and verification of beneficial owners. Incomplete, outdated, or unreliable beneficial ownership information makes the screening process challenging. Additionally, beneficial ownership information is often not publicly accessible, posing hurdles for financial institutions in obtaining necessary data. They must rely on alternative sources and collaboration with other entities to gather relevant information.

- Technology limitations and advancements: UBO screening is complex and time-consuming, demanding advanced technological solutions. Financial institutions may face limitations in adopting the right technologies, hindering their ability to efficiently screen for beneficial ownership. However, investments in innovative technologies and strong AML Compliance solutions enable automation and streamline the UBO screening process, enhancing accuracy and efficiency.

- Cost implications: Implementing comprehensive UBO screening programs can be costly, especially for financial institutions with resource constraints. Limited investment in robust screening processes can impact the effectiveness of UBO screening.

- Regulatory complexity and political interference: The intricate and evolving nature of UBO screening regulations creates challenges in navigating and adhering to requirements effectively. In certain jurisdictions, political pressures can impede thorough investigations or raise concerns about specific individuals or entities, making UBO screening more challenging.

- Lack of international cooperation and collaborative partnerships: Effective UBO screening relies on collaboration and information sharing between countries. However, some jurisdictions may be reluctant to cooperate, making it difficult for financial institutions to identify and verify beneficial owners with cross-border interests. Establishing alliances with other financial institutions and government agencies fosters information exchange, improving the overall effectiveness of UBO screening efforts.

Despite these persistent challenges, financial institutions have to put in place the necessary processes and invest the needed effort to have a robust UBO screening process.

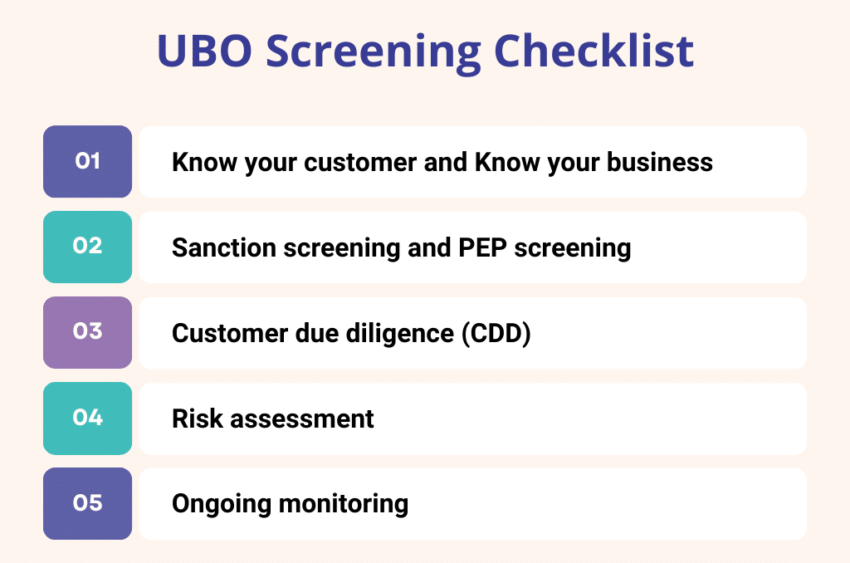

Processes and requirements involved with UBO Screening:

Conducting a comprehensive Ultimate Beneficial Owner (UBO) screening requires financial institutions to meet various requirements and implement key processes. These include Know Your Customer (KYC) and Know Your Business (KYB) procedures, risk assessment, and screening measures. Let’s delve into the essential elements of a comprehensive UBO screening process:

- KYC and KYB processes: Financial institutions must follow robust KYC and KYB processes to collect and verify customer information and business details. This involves obtaining relevant identification documents, proof of address, and legal entity documentation, such as registration certificates or articles of incorporation. KYC and KYB procedures establish the foundation for accurate UBO screening by ensuring the authenticity of customer and business information.

- Sanction screening and PEP screening: Comprehensive UBO screening requires financial institutions to perform sanction screening and Politically Exposed Person (PEP) screening. Sanction screening involves checking individuals and entities against global sanction lists to identify any connections to illegal activities or restricted parties. PEP screening involves identifying individuals who hold prominent public positions and assessing the potential risk associated with their involvement in financial transactions.

- Customer due diligence (CDD): Financial institutions must conduct thorough customer due diligence, which involves gathering detailed information about the customer’s financial profile, transaction history, fortune sources, and business relationships. CDD helps in understanding the purpose and nature of the customer’s transactions, ensuring compliance with anti-money laundering (AML) regulations, and mitigating the risk of illicit activities.

- Risk assessment: Financial institutions need to conduct a risk assessment to evaluate the potential risks associated with the identified beneficial owners. This involves assessing factors such as their reputation, involvement in high-risk industries or activities, and exposure to money laundering or terrorist financing. Risk assessment enables financial institutions to determine the level of due diligence required and allocate resources effectively.

- Ongoing monitoring: UBO screening is an ongoing process, and financial institutions are required to continuously monitor and update UBO information. This includes periodically reviewing customer profiles, verifying UBO details, and conducting regular screenings against updated sanction lists and PEP databases. Ongoing monitoring ensures that any changes in beneficial ownership or potential risks are promptly identified and addressed.

UBO screening best practices

To ensure effective UBO screening, organizations should adopt the following best practices:

- Risk-based approach: Employing a risk-based approach ensures that financial institutions prioritize UBO screening for high-risk customers and transactions, focusing resources where they are most needed to combat money laundering and other illicit activities.

- Diversified data sources: Using a variety of reliable sources, such as public records, government databases, and commercial databases, allows institutions to gather comprehensive information about customers and their beneficial owners, enhancing the accuracy and reliability of UBO screening outcomes.

- Thorough information verification: Financial institutions should validate the collected data by cross-referencing multiple sources and directly engaging with customers. This ensures the integrity of the information and reduces the risk of false or misleading identification.

- Comprehensive staff training: Equipping staff with in-depth training on UBO screening requirements and best practices empowers them to effectively identify and report suspicious activity, reinforcing the institution’s compliance efforts and creating a vigilant culture within the organization.

- Regular policy and procedure reviews: Financial institutions should regularly review and update their UBO screening policies and procedures to align with evolving regulatory standards and emerging risks. This proactive approach ensures that screening practices remain robust and effective.

- Get third-party investigation services: In case of unavailable information companies should resort to third-party companies specializing in UBO reporting and investigation on a deeper level to make sure they don’t get in the trap of doing business with criminals.

- Using technology: Technology indeed helps in the process of UBO screening since it automates and dematerializes a lot of the verification and additional documentation requirement tasks. It also helps create automatic decision workflows and centralizes the investigation process.

Ultimate Beneficial Ownership (UBO) screening plays a pivotal role in promoting transparency, integrity, and security in the global financial system. Recent updates in Europe, the USA, and the Middle East demonstrate the concerted efforts to strengthen UBO regulations. While challenges persist, technology offers robust support in streamlining UBO screening processes. By adopting best practices and leveraging advanced tools, organizations can effectively identify and verify UBOs, mitigating the risk of financial crimes and contributing to a more transparent and secure business environment.

Compliance with UBO regulations is not just a legal requirement; it is an ethical imperative for all stakeholders in the fight against illicit financial activities.