PEP Screening: Red Flags, Advanced Techniques, and Strategic Implementation

In the ever-evolving landscape of financial services, regulatory compliance stands as a paramount concern for institutions worldwide. Among the key pillars of compliance is the meticulous screening of Politically Exposed Persons (PEPs), essential for safeguarding against financial crimes. As technological innovations continue to reshape the landscape, leveraging state-of-the-art solutions for PEP screening isn’t just advantageous but often essential for maintaining compliance in today’s ever-evolving regulatory environment.

Understanding PEP Screening:

Politically Exposed Persons (PEPs) occupy positions of authority or influence, are entrusted with significant public responsibilities, or hold affiliations with such figures. Their elevated status makes them inherently susceptible to exploitation for illicit financial activities due to the potential for undue influence, bribery, or corruption. PEP screening represents a comprehensive process aimed at meticulously scrutinizing the financial activities and associations of these individuals. Through rigorous examination, financial institutions assess the risk of their involvement in money laundering, embezzlement, or other forms of financial misconduct. This scrutiny extends beyond the individuals themselves to encompass their close associates and family members, recognizing the potential for indirect influence or involvement in illicit activities. Ultimately, PEP screening serves as a vital safeguard against the infiltration of illicit funds into the financial system, preserving integrity and trust within the global financial ecosystem.

PEP Screening: what are the red flags

High-Profile Positions:

Individuals holding influential roles, such as government officials, heads of state, legislators, and their close associates, are under intense scrutiny. The focus here is on identifying potential vulnerabilities to engaging in illicit activities, considering the significant impact these figures can have.

Frequent International Transactions:

Patterns of international transactions raise alarms, as politically exposed persons (PEPs) may exploit cross-border dealings to mask the origin and nature of funds. This intricate web complicates the detection of illicit financial activities, demanding heightened vigilance.

Unexplained Wealth:

Clients experiencing unexplained increases in wealth or engaging in transactions disproportionate to their known income trigger red flags. This signals potential involvement in illicit financial activities, necessitating a watchful eye and thorough investigation into these financial anomalies.

Complex Corporate Structures:

Accounts tied to intricate corporate structures undergo in-depth analysis. PEPs often utilize complex arrangements to conceal their participation in financial transactions, requiring advanced scrutiny and meticulous due diligence to unveil potential irregularities in these complex webs.

Transactions in High-Risk Jurisdictions:

Transactions involving countries with lax anti-money laundering regulations or high corruption levels are flagged for scrutiny. The emphasis is on preventing the laundering of illicit funds, underscoring the need for robust examination in transactions associated with these high-risk jurisdictions.

To remain fully compliant and safeguard against financial crimes, financial institutions must not only comprehend the nuances of PEP screening but also implement robust AML compliance technologies

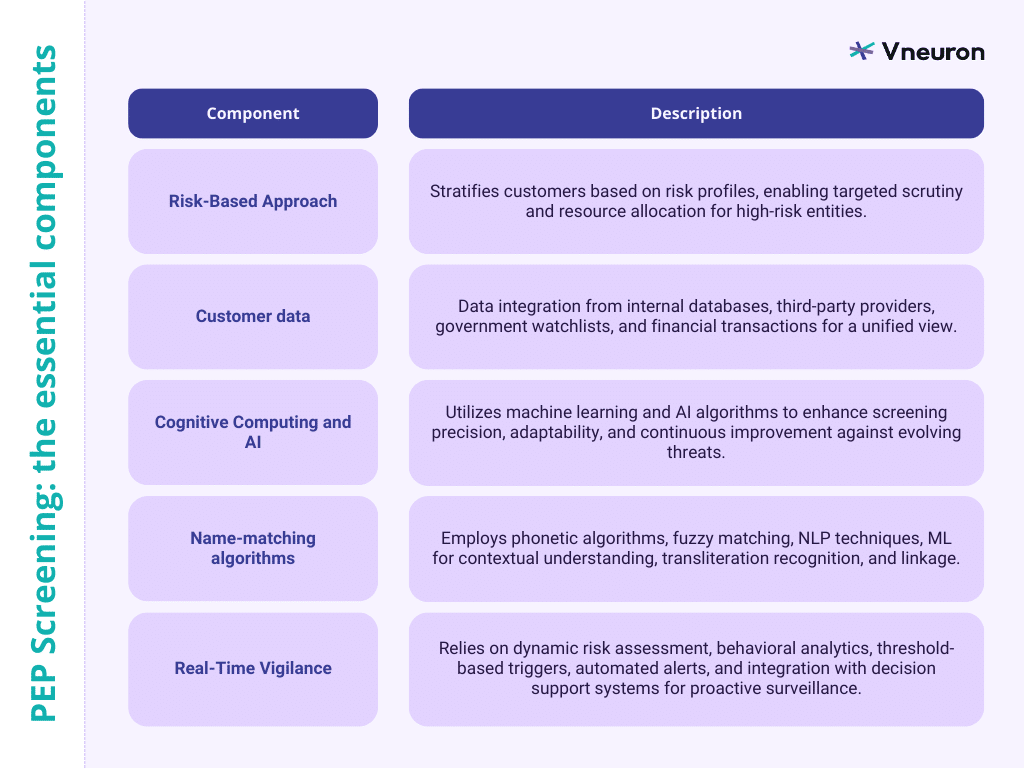

PEP Screening: the essential components for high efficiency

1. Risk-Based Approach:

Adopting a risk-based Approach for PEP screening is not merely a strategic choice but an integral part of AML compliance planning. It signifies a fundamental shift towards a proactive and targeted approach, enabling financial institutions to navigate financial criminality challenges with unparalleled precision and efficacy.

At its core, the risk-based approach involves the methodical stratification of customers into distinct risk categories, each meticulously crafted to reflect varying degrees of potential risk. This stratification is not a one-size-fits-all endeavor but a bespoke process, tailored to the unique characteristics and behaviors of individual customers. By delving into granular details such as transaction history, geographical location, business affiliations, and historical patterns of behavior, financial institutions gain a nuanced understanding of the risk landscape.

Once customers are stratified based on their risk profiles, financial institutions can orchestrate resource allocation with precision. High-risk entities, identified through the meticulous risk assessment process, undergo an exhaustive screening process that leaves no stone unturned. This scrutiny extends beyond mere transactional analysis to encompass a holistic examination of financial activities, associations, and potential red flags indicative of illicit behavior.

Moreover, the risk-based approach strikes a delicate balance between thoroughness and efficiency. While high-risk entities warrant heightened scrutiny, lower-risk profiles benefit from a streamlined process that optimizes resource utilization without compromising compliance standards. This harmonious equilibrium ensures that financial institutions uphold the highest standards of integrity and due diligence while maximizing operational efficiency.

2. Data Fusion and Synergy:

The effectiveness of PEP screening relies on the adept integration and aggregation of customer data from a multitude of sources. Leveraging cutting-edge data integration platforms and APIs is the cornerstone, empowering financial institutions to construct a unified and exhaustive view of customer data.

Data Sources:

Internal Databases: Aggregate data from internal databases, including customer profiles, transaction histories, and account information.

Third-Party Data Providers: Access data from reputable third-party sources that provide additional insights into customer backgrounds, affiliations, and financial activities.

Government Watchlists: Integrate data from government-issued watchlists containing information about politically exposed persons (PEPs) and individuals with high-risk associations.

Financial Transactions: Extract data from transaction records, analyzing patterns and anomalies that may indicate suspicious financial activities.

APIs for Seamless Integration:

RESTful APIs: Implement Representational State Transfer (REST) APIs for smooth and efficient communication between different systems, ensuring real-time data updates and retrieval.

GraphQLAPIs: Leverage GraphQL APIs for flexible and precise data queries, allowing financial institutions to tailor requests and responses according to specific PEP screening requirements.

Data Aggregation APIs: Implement APIs specifically designed for data aggregation, enabling the consolidation of information from various sources into a centralized repository.

AML Data Exchange APIs: Utilize specialized APIs designed for AML compliance, facilitating the exchange of pertinent information between financial institutions and regulatory bodies.

3. Cognitive Computing and Artificial Intelligence:

Elevating PEP screening to new heights involves a strategic amalgamation of Cognitive Computing and Artificial Intelligence (AI). This technological synergy harnesses the power of machine learning (ML) algorithms, creating a dynamic framework that redefines the precision and effectiveness of PEP screening protocols.

Machine Learning Algorithms: The Analytical Backbone

Unlike traditional screening methods, which may struggle to handle the sheer volume and complexity of modern financial data, ML algorithms excel in discerning intricate patterns and identifying anomalies that might escape human scrutiny.

These algorithms operate in a data-driven paradigm, learning from historical data patterns to make predictions and decisions without explicit programming. This adaptability allows financial institutions to stay ahead in the ever-evolving landscape of financial transactions.

Continuous Evolution of AI-Driven Systems: Staying Ahead of Threats

The synergy of Cognitive Computing and AI extends beyond static algorithms. AI-driven systems learn from new data, adapting to emerging threats and evolving compliance requirements. This continuous learning loop ensures that PEP screening protocols remain effective and up-to-date in the face of evolving financial risks.

The adaptability of AI-driven systems is particularly crucial in the context of the dynamic nature of financial crimes. Threats are not static, and neither should the systems designed to thwart them. The continuous evolution of these systems acts as a proactive defense mechanism, anticipating and mitigating risks before they can escalate.

Enhancing Efficacy through Anomaly Detection: Precision Unveiled

One of the standout features of Cognitive Computing and AI in PEP screening lies in their ability to unveil subtle anomalies and irregularities within vast datasets. Traditional screening methods often struggle to identify nuanced patterns indicative of potential risks. In contrast, AI excels in anomaly detection, uncovering irregularities that might go unnoticed, thus elevating the precision of PEP identification.

The intricacies of financial transactions, combined with the diverse nature of customer data, make anomaly detection a critical component of effective PEP screening. Cognitive Computing, fueled by AI, excels in this domain by dissecting and understanding intricate data relationships, contributing to the heightened accuracy of the overall screening process.

4. Name Matching Ingenuity:

Elevating precision in PEP identification demands a sophisticated arsenal of name-matching algorithms, where cutting-edge technology takes center stage. These algorithms serve as the gatekeepers, transcending linguistic challenges and accounting for the intricacies of human nomenclature, ultimately refining the process of identifying Politically Exposed Persons (PEPs) within customer databases

Phonetic Algorithms for Sound-Alike Matches:

At the core of name-matching ingenuity lies the utilization of phonetic algorithms, capable of recognizing sound-alike matches. This technology accounts for the inherent variations in pronunciation, enabling the system to identify potential matches even when spellings differ. By leveraging algorithms like Soundex or Metaphone, financial institutions ensure that names with similar phonetic structures are flagged for further scrutiny.

Fuzzy Matching for Flexibility:

Introducing a layer of flexibility, fuzzy matching algorithms play a crucial role in accommodating spelling variations. Unlike rigid exact matching, fuzzy matching considers the degree of similarity between strings, allowing for a certain level of tolerance for spelling discrepancies. The Levenshtein distance algorithm, for instance, quantifies the minimum number of single-character edits required to transform one string into another, offering a nuanced approach to name matching.

Natural Language Processing (NLP) techniques play a pivotal role in implementing fuzzy matching algorithms effectively. NLP algorithms enable the processing and analysis of textual data, facilitating the identification of linguistic patterns, semantic similarities, and contextual cues.

Machine Learning for Contextual Understanding:

Harnessing the power of Machine Learning (ML), name-matching algorithms evolve beyond predefined rules. ML models are trained on vast datasets, learning patterns, and contextual nuances inherent in names. This allows the system to adapt and improve its matching accuracy over time, ensuring a more sophisticated and context-aware approach to PEP identification.

Transliteration Recognition for Cross-Language Matching:

Advanced algorithms equipped with transliteration recognition capabilities ensure that names written in different scripts are appropriately matched. By considering variations resulting from language differences, these algorithms mitigate the risk of overlooking PEPs with names represented in diverse linguistic forms.

Probabilistic Record Linkage for Comprehensive Analysis:

For a holistic approach to name matching, probabilistic record linkage algorithms come into play. These algorithms assess the likelihood of records being a match, considering various attributes beyond names. By incorporating probabilistic models, financial institutions enhance the overall accuracy of PEP identification, minimizing both false positives and negatives in their screening processes.

5. Real-Time Vigilance:

The imperative to instill a culture of real-time vigilance is met through the strategic utilization of advanced analytics tools, establishing an environment of proactive surveillance within PEP screening processes. Real-time monitoring, the heartbeat of this vigilance, goes beyond mere observation, actively detecting and responding promptly to changes in customer risk profiles.

Dynamic Risk Assessment:

Real-time vigilance begins with a dynamic risk assessment framework. This involves continuously evaluating and updating customer risk profiles based on evolving factors such as transaction behavior, geographical anomalies, and external intelligence feeds. Advanced analytics, driven by machine learning algorithms, enable the system to adapt swiftly to emerging patterns, ensuring a responsive risk assessment mechanism.

Behavioral Analytics:

Implementing behavioral analytics is a pivotal aspect of real-time vigilance. By analyzing patterns in customer behavior, institutions can establish a baseline for normal activity. Any deviation from this baseline triggers immediate alerts, allowing for swift investigation and response. This approach provides a nuanced understanding of customer behavior, enhancing the precision of PEP screening.

Threshold-Based Triggers:

Real-time monitoring incorporates threshold-based triggers to identify significant deviations or anomalies in customer transactions. These triggers are set based on predefined thresholds for specific risk indicators. For instance, sudden and substantial changes in transaction amounts, frequency, or destinations can activate these triggers, signaling potential risks that demand immediate attention.

Automated Alerts and Notifications:

To ensure prompt response times, real-time vigilance integrates automated alerting systems. Upon the detection of any suspicious activity or changes in PEP status, these systems generate instant alerts and notifications to relevant personnel or decision-makers. This automation minimizes response times, enabling swift decision-making in the face of potential threats.

Integration with Decision Support Systems:

Real-time vigilance extends its impact through seamless integration with decision support systems. This integration ensures that not only are anomalies detected promptly, but decision-makers also have access to comprehensive data and insights. A holistic view allows for informed decision-making, empowering institutions to respond effectively to evolving PEP risk scenarios.

As financial institutions embrace the imperative of real-time vigilance in PEP screening processes, the journey toward technological supremacy unfolds. This journey necessitates a comprehensive and strategic approach, beginning with a holistic assessment of existing processes and culminating in the seamless integration of cutting-edge technologies.

Strategic Implementation Guide: How to Start with PEP Screening

1. Holistic Process Assessment:

Embarking on the path to technological supremacy demands a thorough understanding of the existing PEP screening processes. Initiate this journey with a comprehensive and holistic assessment, delving into the intricacies of each process. Identify areas ripe for enhancement, paying meticulous attention to scalability and adaptability to technological advancements. This assessment serves as the cornerstone for a strategic transformation, ensuring that every facet of PEP screening aligns seamlessly with the institution’s technological vision

2. Strategic Technology Selection:

Selecting PEP screening solutions is a pivotal decision that demands precision. Align these solutions with the unique needs and scale of your institution, considering the complexities of your operations. Prioritize seamless integration with existing systems, ensuring a harmonious fusion that maximizes efficiency. Look beyond immediate needs and prioritize solutions offering scalability and future-proofing, laying the groundwork for sustained technological excellence.

3. Tailoring and Integration:

Customization emerges as the linchpin for unlocking the full potential of selected technologies. Tailor solutions with high precision to meet the specific requirements of your institution. This meticulous customization ensures that the technology seamlessly integrates with existing databases and systems, minimizing operational disruptions.

4. Knowledge Amplification:

The true power of technology unfolds when wielded by an informed and empowered team. Elevate your staff’s proficiency by implementing comprehensive training programs. Equip them not only with the technical know-how but also with a deep understanding of machine learning algorithms, AI-driven systems, and other cutting-edge screening tools. Knowledge amplification transforms your team into adept navigators of the technological landscape, enhancing both efficiency and effectiveness.

5. Dynamic Monitoring and Evolution:

Establish a dynamic system for continuous monitoring and evaluation, forming the backbone of sustained excellence. Regularly scrutinize the performance of PEP screening processes, staying vigilant against emerging threats and evolving regulatory landscapes. Financial institutions must Implement a culture of constant evolution, where technologies are regularly updated and upgraded. This ensures that the institution stays at the forefront of AML compliance, adapting swiftly to changes and solidifying its position as a technological trailblazer.

As the financial landscape continues to evolve, staying ahead of regulatory demands remains imperative for institutions worldwide. By embracing advanced PEP screening techniques and strategic implementation strategies, financial organizations can fortify their compliance frameworks while optimizing operational efficiency.

At Vneuron, we specialize in cutting-edge solutions tailored to your institution’s unique needs. With our expertise in AI-driven technologies and tailored solutions, we empower institutions to navigate regulatory complexities with confidence.

Contact us today to learn more about how Vneuron can elevate your PEP screening processes.