A Comprehensive Guide to AML Compliance in Neobanks

Blog preview

In recent years, neobanks have emerged as disruptive players in the financial industry, offering customers a digital-first banking experience. As these innovative institutions gain traction, the importance of Anti-Money Laundering (AML) compliance becomes paramount. Throughout this blog post, we will explore the challenges, regulations, and best practices that shape AML compliance in neobanks.

Understanding Neobanks and Their Rise

The term “neobank” refers to digital-only banks that operate without physical branches. These institutions leverage technology to provide customers with a seamless, user-friendly banking experience, often in contrast to traditional banks.

The rapid rise of neobanks is attributed to their agility, lower operational costs, and ability to cater to a tech-savvy customer base.

Despite their advantages, neobanks face unique challenges, including establishing trust in a digital environment, meeting regulatory requirements, and effectively implementing AML compliance measures.

Regulatory Landscape for Neobanks

The regulatory landscape for neobanks is multifaceted, encompassing a range of laws and regulations designed to ensure the stability, security, and integrity of the financial system. Understanding the specific regulatory framework that applies to neobanks is crucial for effective AML compliance. Here, we explore the key laws and regulations neobanks must adhere to, along with distinctions between neobank regulations and those applicable to traditional banks.

AML Regulations for Neobanks

Neobanks are subject to the same foundational AML regulations as traditional banks, emphasizing the prevention and detection of financial crimes.

Some of the key AML regulations include:

- Bank Secrecy Act (BSA): A foundational piece of U.S. AML legislation, the BSA requires neobanks to maintain certain records and file reports that have a high degree of usefulness in criminal, tax, and regulatory investigations.

- Financial Action Task Force (FATF) Recommendations: As a global standard-setter, FATF provides recommendations that influence national and international AML regulations. Neobanks must align their practices with these recommendations to maintain a consistent and robust approach to AML compliance.

- Know Your Customer (KYC) Regulations: Neobanks are obligated to implement comprehensive KYC procedures to verify the identity of their customers. This includes collecting and verifying customer information and monitoring transactions for any unusual or suspicious activities.

- Customer Due Diligence (CDD): The CDD requirements mandate that neobanks assess the risk profile of their customers, particularly those posing a higher risk of money laundering or terrorist financing. Enhanced Due Diligence (EDD) may be required for high-risk customers.

Specific Laws for Neobanks

While neobanks adhere to general AML regulations, some jurisdictions have introduced specific laws tailored to the unique characteristics of neobanks. These laws recognize the digital nature of neobank operations and aim to address associated challenges.

Examples include:

- Electronic Money Regulations (EMRs): In many regions, neobanks fall under EMRs, which focus on the issuance of electronic money and the provision of payment services. Compliance with EMRs is essential for neobanks engaged in digital transactions.

- Open Banking Regulations: Neobanks often operate within open banking ecosystems, sharing customer data through Application Programming Interfaces (APIs). Regulations related to open banking aim to ensure secure data-sharing practices while safeguarding customer privacy.

- Data Protection Laws: Given the digital nature of neobanks, compliance with data protection laws, such as the GDPR, is crucial. Neobanks must safeguard customer data, ensuring it is collected, processed, and stored following privacy regulations.

Challenges in AML Compliance for Neobanks

Digital Onboarding of Customers:

- Geographic and Cultural Variability: Neobanks operating globally must navigate diverse geographic and cultural landscapes, each with its own set of challenges related to digital onboarding. Adapting processes to different regulatory environments and cultural expectations poses a considerable challenge.

- User-Friendly Authentication: Balancing robust security measures with a seamless and user-friendly experience is crucial. Neobanks must implement authentication methods that are not only secure but also convenient for customers, minimizing friction in the onboarding process.

Transaction Monitoring:

- False Positives and Alert Fatigue: Implementing sophisticated systems for real-time transaction monitoring often leads to a high number of false positives. Neobanks face the challenge of refining algorithms to reduce false alerts, preventing alert fatigue among compliance teams.

- Adapting to Evolving Threats: Money launderers are continually evolving their tactics. Neobanks must stay ahead of emerging threats by regularly updating and adapting their transaction monitoring systems, leveraging machine learning to identify new patterns and techniques.

Handling Cross-Border Transactions:

- Currency Exchange Challenges: Cross-border transactions involve currency exchange, introducing an additional layer of complexity. Neobanks must navigate fluctuating exchange rates and comply with regulatory requirements for currency conversions.

- Legal and Jurisdictional Variations: Neobanks operating across borders encounter diverse legal frameworks and jurisdictional variations. Understanding and complying with these differences is critical to avoid legal complications and regulatory scrutiny.

Regulatory Compliance:

- Rapidly Changing Regulatory Environment: The dynamic nature of the regulatory landscape poses challenges for neobanks. Staying abreast of changes in AML regulations globally and adapting internal processes accordingly is an ongoing challenge.

- Regulatory Scrutiny and Enforcement: Neobanks may face increased scrutiny due to their innovative nature. Ensuring compliance with AML regulations and effectively communicating their adherence to regulatory authorities is essential to avoid legal consequences.

Critical Technologies for AML Compliance in Neo banks

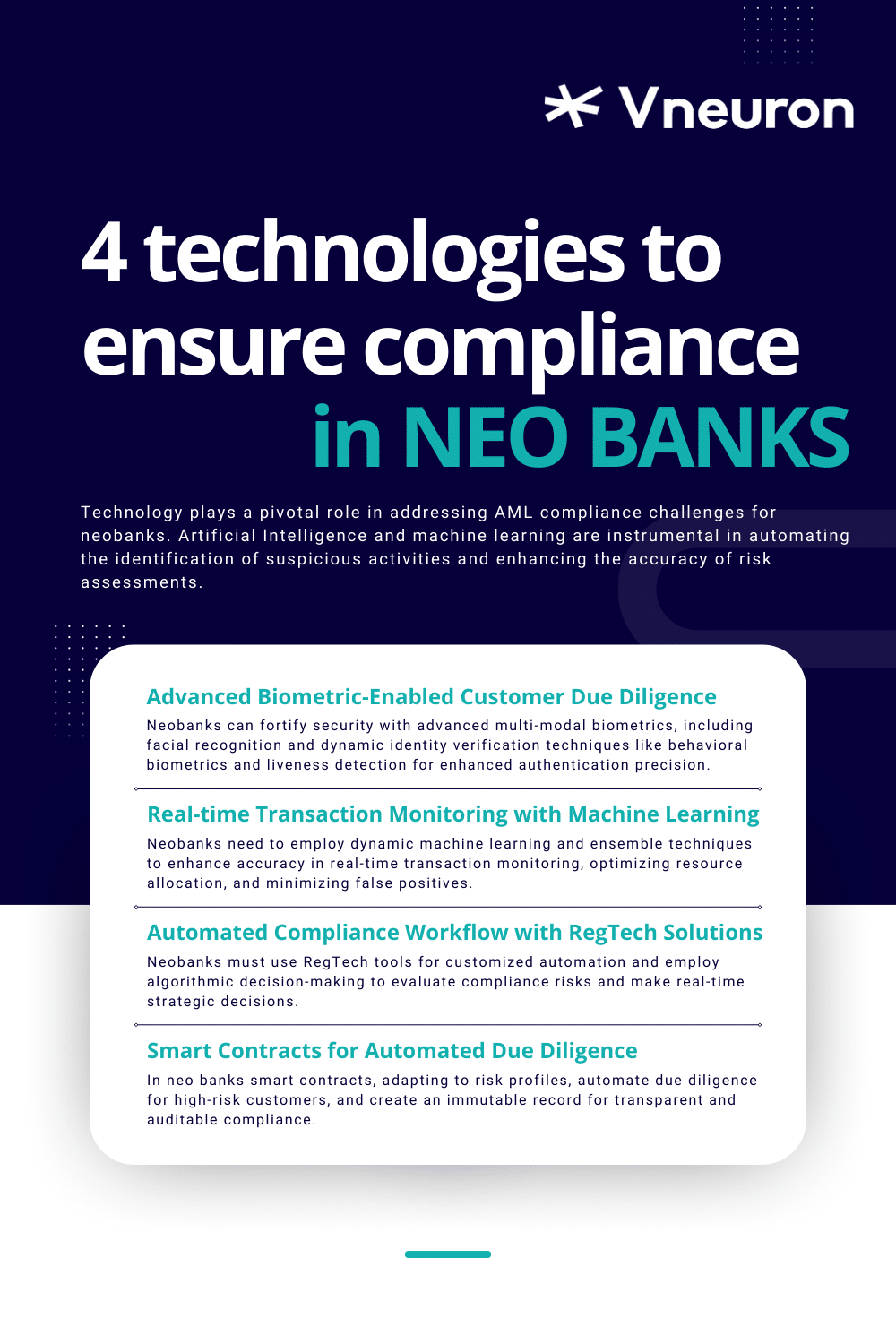

Technology plays a pivotal role in addressing AML compliance challenges for neobanks. Artificial Intelligence and machine learning are instrumental in automating the identification of suspicious activities and enhancing the accuracy of risk assessments. Neobanks can leverage these technologies to continuously monitor transactions, detect anomalies, and adapt to evolving money laundering techniques.

Advanced Biometric-Enabled Customer Due Diligence:

- Implementation of Multi-Modal Biometrics: Neobanks, in adherence to a risk-based approach, strategically deploy advanced multi-modal biometric authentication mechanisms tailored for higher-risk customers. This includes the integration of facial recognition, fingerprint scanning, and voice recognition technologies to not only bolster the precision of identity verification during onboarding but also to fortify the overall security architecture.

- Dynamic Identity Verification Techniques: Beyond traditional biometrics, neobanks can employ dynamic identity verification techniques. Behavioral biometrics, which analyzes patterns in user behavior, and liveness detection, ensuring the presence of a live individual during the authentication process, add layers of complexity and security to the biometric framework.

Real-time Transaction Monitoring with Machine Learning:

- Dynamic Machine Learning Algorithms: Embracing a risk-based approach mandates the implementation of dynamic machine learning algorithms for real-time transaction monitoring. These algorithms, powered by adaptive models, prioritize the analysis of higher-risk transactions. The result is a targeted strategy that minimizes false positives and optimizes the allocation of compliance resources.

- Ensemble Learning for Enhanced Accuracy: Neobanks can enhance the efficiency of machine learning models by incorporating ensemble learning techniques. This involves the combination of multiple models to improve prediction accuracy and robustness, ensuring that the detection of suspicious transactions is both precise and adaptable to evolving patterns.

Automated Compliance Workflow with RegTech Solutions:

- Integration of RegTech Tools: The risk-based approach directs the seamless integration of Regulatory Technology (RegTech) tools, enabling neobanks to customize automation in alignment with higher compliance risk areas. This strategic utilization ensures that automated processes, including policy updates and reporting mechanisms, are precisely calibrated to manage risks in a prioritized and efficient manner.

- Algorithmic Compliance Decisioning: RegTech solutions can incorporate algorithmic decision-making processes. This involves using complex algorithms to evaluate compliance risks, enabling neobanks to make informed decisions on risk management, compliance strategies, and resource allocation based on real-time data.

Smart Contracts for Automated Due Diligence:

- Dynamic Smart Contract Execution: Smart contracts, when applied within the risk-based context, dynamically execute based on the nuanced understanding of customer risk profiles. For higher-risk customers, smart contracts trigger more elaborate and frequent automated due diligence processes. This ensures a tailored and responsive approach to compliance that adapts in real-time to the evolving risk landscape.

- Immutable Compliance Execution: Leveraging blockchain-inspired principles, smart contracts in the compliance workflow provide an immutable record of executed due diligence processes. This not only enhances transparency but also offers a secure and auditable trail for regulatory scrutiny.

These best practices empower neobanks to not only meet but surpass AML compliance requirements, leveraging state-of-the-art technologies with a technical precision that aligns with the intricate demands of modern digital banking.

How Vneuron Can Assist Neobanks in their AML Compliance Journey:

Customized AML Solutions:

- Tailored Risk-Based Approach: Vneuron provides neobanks with customizable AML solutions, incorporating a risk-based approach. These solutions align with the specific risk profiles and operational intricacies of neobanks, ensuring that compliance efforts are precisely targeted where they matter most.

- All-in-one Scalable Technology Infrastructure: Vneuron’s scalable technology infrastructure accommodates the growth trajectories of neobanks. Whether expanding operations, onboarding a larger customer base, or venturing into new markets, Vneuron’s solution seamlessly adapts to evolving compliance requirements and covers all AML compliance needs which makes it a one-stop shop for neobanks.

Real-time Machine Learning Analytics:

Vneuron’s real-time machine learning algorithms bring a dynamic edge to transaction monitoring. By prioritizing higher-risk transactions and continuously adapting to emerging money laundering tactics, neobanks can reduce false positives and optimize their compliance efforts.

Dynamic Risk Scoring Models:

- Behavioral Analytics for Risk Assessment: A risk-based approach to behavioral analytics involves continuous evaluation but with an emphasis on higher-risk customer segments. Dynamic risk scoring models dynamically adjust risk levels based on changing behavior patterns, allowing for a more precise and responsive risk assessment.

- Integration of AI-driven Risk Models: AI-driven risk models are customized within the risk-based framework to prioritize the analysis of transactions associated with higher-risk customers. This tailored integration enhances the accuracy and timeliness of risk evaluations.

Encryption and Secure Data Handling:

- End-to-End Encryption: The risk-based approach guides the implementation of end-to-end encryption, with a focus on customer data associated with elevated compliance risks. This ensures that the highest levels of security are applied where the risk is deemed more significant.

- Secure Data Handling Protocols: Protocols for handling, storing, and processing customer data are risk-tiered, with a meticulous focus on the highest-risk profiles. Secure data storage solutions and encryption updates are prioritized for the most sensitive customer information.

As the industry continues to innovate, neobanks must remain agile, adaptable, and committed to the highest standards of AML compliance to build lasting trust with customers and regulatory authorities alike.

The journey towards effective AML compliance is continuous, requiring a proactive and collaborative approach to ensure the integrity and security of the financial services provided by neobanks.