HOW WELL DO YOU CONTROL

YOUR TRADE FINANCE RISKS?

Strengthening Trade-Based Money Laundering Controls

A comprehensive, structured, risk-based approach to monitoring international trade transactions.

Trade finance remains one of the most vulnerable channels to illicit financial flows. Criminal networks exploit trade complexity through mispricing, falsified documents, routing manipulations, and shell companies.

A key observation today is that TBML controls are often fragmented, spread across multiple tools for screening, document analysis, and vessel tracking. This fragmentation makes it difficult for compliance teams to maintain a unified view of trade risk

Reis™ TBML helps financial institutions detect and manage TBML risks across the entire trade lifecycle by analyzing essential components of each transaction such as actors, goods, routes, values, and documentation.

Why Strengthen TBML Controls?

Traditional trade monitoring approaches are often limited by manual processes and fragmented information. Institutions face growing pressure due to:

- Lack of information about goods and prices

- High documentation volume

- Cross-border value movements

- Rising regulatory expectations

- Evolving evasion techniques

Reis™ TBML provides a structured and consistent approach to assessing risks throughout the transaction lifecycle.

Core Capabilities of Reis™ TBML

1. Continuous Trade Case Management

Reis™ TBML converts each trade operation into a fully structured TBML case, centralizing all parties, documents, and trade data in one unified workspace. Importers, exporters, goods, routes, issuance details, coverage and more are consolidated to give compliance teams a complete and streamlined view of every transaction.

The solution continuously monitors the full trade lifecycle, assessing each actor and step in real time. Alerts follow a controlled maker-checker workflow to ensure independent review and consistent risk decisions.

Each case includes advanced collaboration and investigation features such as:

- AI-generated summaries: Automatically create summaries that highlight key details for quick understanding.

- Watchers and notifications: Assign watchers to get instant updates on case activities, ensuring stakeholders stay informed.

- RFI management: Manage RFIs directly within the case, keeping all requests and responses in one place.

- Comments and discussion threads: Use comments, mentions, and secure attachments for team collaboration on investigations.

- Full audit trail: Access a complete log of every action and update for compliance and oversight.

- Linked cases and entity relationships: Link related cases and entities to spot patterns and support risk analysis.

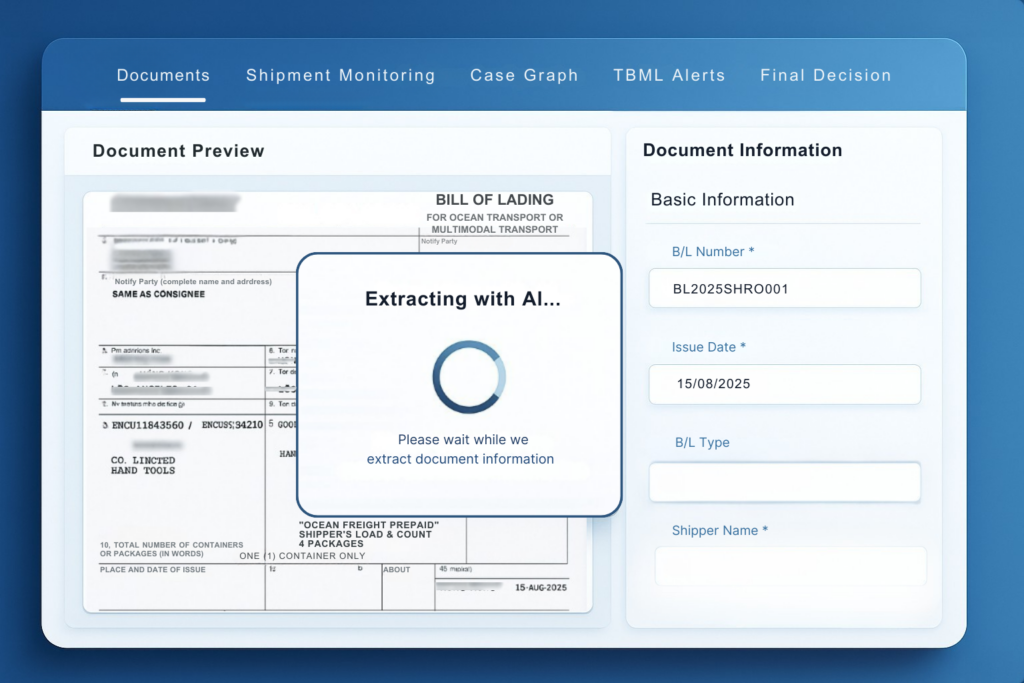

2. AI-Driven Document Intelligence

Reis™ TBML leverages advanced AI to automatically review critical trade documents, including the Bill of Lading, Commercial Invoice, Packing List, Certificate of Origin, and Letter of Credit. It swiftly detects inconsistencies and flags potential TBML risks, ensuring a more reliable and efficient approach to trade compliance.

With this capability, institutions can quickly identify document irregularities, uncover hidden risks, and significantly strengthen their overall TBML risk assessment processes.

Red Flags Detected:

- Dual-Use Goods Detection

- Over-Invoicing Detection

- Under-Invoicing Detection

- Phantom Company Detection

3. Unified Real-Time Trade Analytics

Reis™ TBML provides a complete 360° view of each trade operation through an interactive case graph. All entities, documents, routes, banks, goods and relationships are mapped in real time, allowing analysts to instantly understand the full context of a transaction. The graph highlights connections, risk signals and unusual patterns, helping teams assess TBML exposure with accuracy and speed

Red Flags Detected:

- Price Variance Detection

- Illogical Route Detection

- Round-Trip Transaction

- Offshore Entity Involvement

4. AI-Powered Scenario Authoring

Reis™ TBML streamlines the creation of TBML detection scenarios with smart, automated capabilities.

The AI Rule Assistant enables analysts to express detection needs in plain language and automatically converts them into complete, structured TBML scenarios.

It helps institutions achieve:

- Faster, smarter scenario creation

- Stronger agility in adapting to new risks

- Reduced reliance on IT

Consistent, high-quality rule logic

The AI Rule Assistant enhances innovation, strengthens compliance ownership, and makes scenario management more intuitive.

Red Flags Detected:

- PEP Involvement Detection

- Payment Timing Anomaly

- Price Volatility Analysis

- Sanctioned Entity Match