Vneuron Recognized as a Leader in QKS Group’s SPARK Matrix™: KYC Solutions 2025

Paris, France – 27/08/2025 – Vneuron has been positioned as a Leader in the SPARK Matrix™: Know Your Customer (KYC) Solutions 2025 by QKS Group. The SPARK Matrix™ provides a competitive analysis and ranking of leading KYC solution providers worldwide. Vneuron earned strong ratings in both technology excellence and customer impact, reflecting the strength of its AI-powered technology and commitment to delivering exceptional client value.

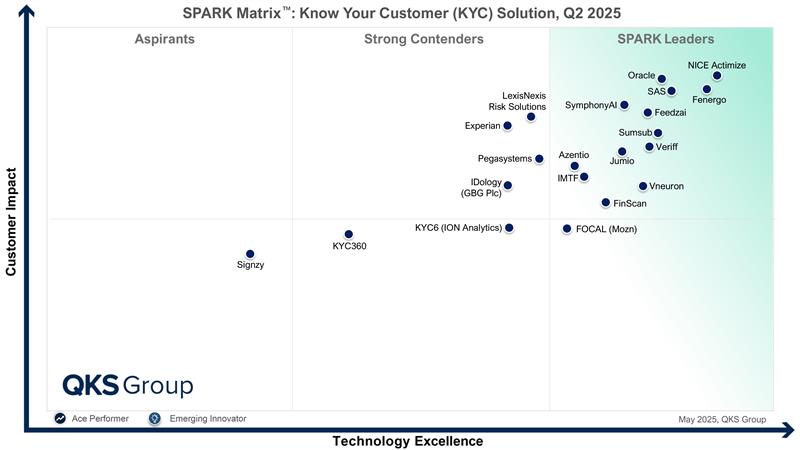

The QKS Group SPARK Matrix™ evaluates vendors based on their technology capabilities and customer impact, offering an in-depth analysis of global market dynamics, major trends, vendor landscapes, and competitive positioning. By providing a competitive analysis and ranking of leading technology vendors, the SPARK Matrix delivers strategic insights that help users assess provider capabilities, differentiate competitively, and understand market positions.

Below is Vneuron’s position in the SPARK Matrix™: Know Your Customer (KYC) Solution, Q2 2025, published by QKS Group, recognizing leading global KYC solution providers based on technology excellence and customer impact:

Vneuron’s KYC solution, delivered through its Reis™ Risk & Compliance Suite, offers a modular, AI-powered compliance platform that spans identity validation, customer due diligence, and ongoing risk assessment. Designed for financial institutions operating across dynamic regulatory landscapes, Vneuron’s KYC hub supports configurable risk scoring models, automated segmentation, and behavior-driven risk recalibration. Features such as real-time sanctions & watchlists, PEPs, and adverse media screening, event-triggered customer reviews, and entity, network and multi-tier UBO mapping ensure compliance is maintained throughout the customer lifecycle. Institutions can leverage the solution’s no-code workflow builder, case management engine, and explainable AI modules to streamline onboarding, enforce policy-aligned actions, and manage regulatory disclosures with precision.

“Vneuron is redefining digital KYC through risk-contextual intelligence, multi-jurisdictional adaptability, and AI-enabled customer lifecycle management. The platform features real-time due diligence, adaptive workflows, automated periodic reviews, multi-tenancy for cross-jurisdictional compliance, native GoAML integration, and SAR-readiness powered by generative AI. By bringing these capabilities into a single modular environment, the Vneuron Reis™ Risk & Compliance platform enables institutions to manage compliance obligations at scale. Designed to function both as a standalone KYC hub and as a compliance fabric embedded across the customer lifecycle, Vneuron’s platform equips institutions to adapt rapidly to evolving regulatory demands, providing a strategic compliance infrastructure built for transparency, extensibility, and long-term regulatory resilience.” said Siddharth Arya, Senior Analyst at QKS Group.

QKS Group defines “Know Your Customer (KYC) solution as an integrated technology framework that helps financial institutions verify customer identities, assess risk, and meet regulatory requirements across jurisdictions. A comprehensive end-to-end KYC solution integrates key processes such as customer onboarding, sanctions and PEP screening, Customer Due Diligence (CDD), risk assessment and scoring, and ongoing monitoring. Leveraging AI, machine learning, and advanced analytics, robust KYC solutions analyze customer data and behavioral patterns to detect anomalies and flag potential risks. These solutions also support perpetual KYC (pKYC), beneficial ownership analysis, and real-time decisioning, enhancing accuracy and responsiveness. By automating core compliance functions and enabling seamless integration with internal systems and external data sources, a comprehensive KYC solution improves accuracy, efficiency, and strengthens an institution’s financial crime risk management framework.”

“Being named a Leader in the SPARK Matrix™ for KYC Solutions 2025 reinforces our long-standing commitment to delivering recognized, innovative compliance solutions to financial institutions,” said Mahmoud Mhiri, Executive Partner at Vneuron. “It highlights our focus on leveraging AI to deliver stronger, more efficient KYC and AML solutions that help financial institutions identify risks early, streamline their operations, and navigate complex regulatory environments with confidence. This recognition reflects the dedication of our teams to continuous innovation and the trust our clients place in us to support their compliance goals worldwide.”

About Vneuron

Vneuron is a leading provider of advanced AML compliance technology, trusted by financial institutions and fintechs worldwide. Its flagship platform, Reis™ Risk & Compliance Suite, offers scalable, customizable solutions that leverage AI, machine learning, and automation to detect financial crime, streamline alert management, and boost operational efficiency. Vneuron is driving innovation in financial crime prevention, helping clients confidently navigate evolving regulatory landscapes.

About QKS Group:

QKS Group is a global advisory and consulting firm focused on helping clients achieve business transformation goals with Strategic Business and Growth advisory services. At QKS Group, our vision is to become an integral part of our client’s business as a strategic knowledge partner. Our research and consulting deliverables are designed to provide comprehensive information and strategic insights for helping clients formulate growth strategies to survive and thrive in ever-changing business environments.

For more available research, please visit https://qksgroup.com/